Once it is approved, the nonprofit can start to implement https://www.bookstime.com/ the budget and track its actual spending against it.

Budgeting for Nonprofit Organizations and How To Do It Right Everytime

Based on your current cash flow, previous financial performance, and expected income, create detailed budgets for your organization’s spending. Using both your historical financial data and financial projections will help you set realistic spending thresholds, which is crucial for effective planning and goal-setting. Deciding where to keep your nonprofit’s various cash reserves is a major part of cash management. Where you store your funds determines important factors like your interest rates, FDIC insurance coverage, and fund liquidity (how quickly you can access and withdraw your funds). Each component of the nonprofit business model—the delivery model and the funding model—has implications for organizational cash flow that should be understood for effective financial planning.

A Nonprofit Accounting Guide to Cash Flow Forecasting for 2022

If revenue appears to be coming in under budget, staff can be involved in proposing annual budget modifications to preserve good financial health. One important function of the accounting or bookkeeping team is to stay current with cash forecasting. Having a good handle on daily cash management and future cash needs will allow the organization to continue to run like it’s supposed to. Nonprofits are born with a purpose and ensuring their successful future needs to remain a priority. If the net change in cash is positive, then that means the nonprofit is ending the period with more cash than it started with, while a negative change indicates that the nonprofit’s cash on hand has decreased.

Free Webinar: Helping your not-for-profit organization weather the economic storm

In-kind donations and sponsorships typically aren’t noted on the statement of cash flows. This is because gifts of goods, services, and immaterial assets result in a net zero gain in cash for your organization. As a nonprofit organization, one of your primary goals is to ensure that you have the necessary funds to carry out your mission. To that end, it’s important to have a solid understanding of the different ways to generate cash flow. Before a nonprofit can put together a budget, it needs to understand its cash flow—the timing of when it receives and spends money.

- It’s also important to have a contingency plan to cover unexpected expenses or emergencies.

- Thankfully, using the nonprofit statement of cash flows can help you with sound decision-making.

- The fundraising team knows the most about timing of grant payments and donor gifts.

- Diversifying revenue streams helps mitigate this risk by spreading reliance across multiple funding sources.

- Use your income statement and budget to determine your expected cash outflow, and remember that it can fluctuate from month to month.

Regular check-ins help keep policies in place that work for everyone, so take the time to reflect on how things are and are not working. For instance, instead of paying rent, it might make more financial sense to purchase premises. With a sweep account, you can access up to $5 million in FDIC coverage in a single account. Neil Shah has been a non-profit CFO at various organizations for almost 20 years. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

- A statement of cash flow is typically prepared after your Statement of Financial Position and Statement of activities but before your statement of Functional Expenses.

- Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

- Someone within the organization needs to be well versed in the terms to ensure that cash is utilized in accordance with the contract.

- Reviewing cash flow monthly provides a picture of the organization’s financial situation.

- In 2018’s State of the Sector Survey, a large percentage of nonprofits were operating with less than six months’ worth of cash receipts.

- Yet what many of their commercial sector colleagues fail to realize is that things aren’t so straight forward.

- The advantage of creating various cash flow projections is that you can plan your response to different outcomes.

Where Should Nonprofits Keep Their Cash Reserves?

Finally, you may also want to consider partnering with other organizations or businesses. These partnerships can provide much-needed financial support, and they can also help you expand your reach and tap into new resources. By exploring all of your options, you can ensure that your nonprofit has the funds it needs to continue its vital work. There are a number of databases that nonprofit cash flow statement can help you identify potential sources of funding, and many nonprofits also hire grant writers to help them secure additional funding. Keep in mind, however, that grants are often competitive and may require extensive documentation. This means estimating how much money you will need to cover unexpected expenses each year and then setting aside that amount in your budget.

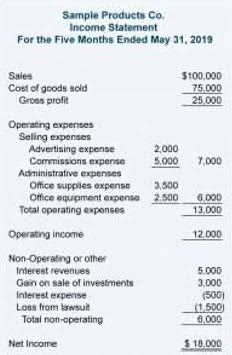

Example Cash Flow Statement for Nonprofit Organizations

- Some organizations will even provide a modified statement of cash flow by month over a 12 or 13 months time period as a way of easily picking up on positive and negative trends or historical ups and downs.

- If you would like to learn more about how the Enkel team can support your organization with our services built specifically for nonprofits, please reach out to us.

- For many nonprofit leaders, half the battle is simply giving money management the attention it requires.

- It can help you track your progress towards your financial goals, and it can help you identify areas where you may need to make changes.

- Jo-Anne Williams Barnes, is a Certified Public Accountant (CPA) and Chartered Global Management Accountant (CGMA) holding a Master’s of Science in Accounting (MSA) and a Master’s in Business Administration (MBA).